Canadian Banking and Finances

Currency and Money

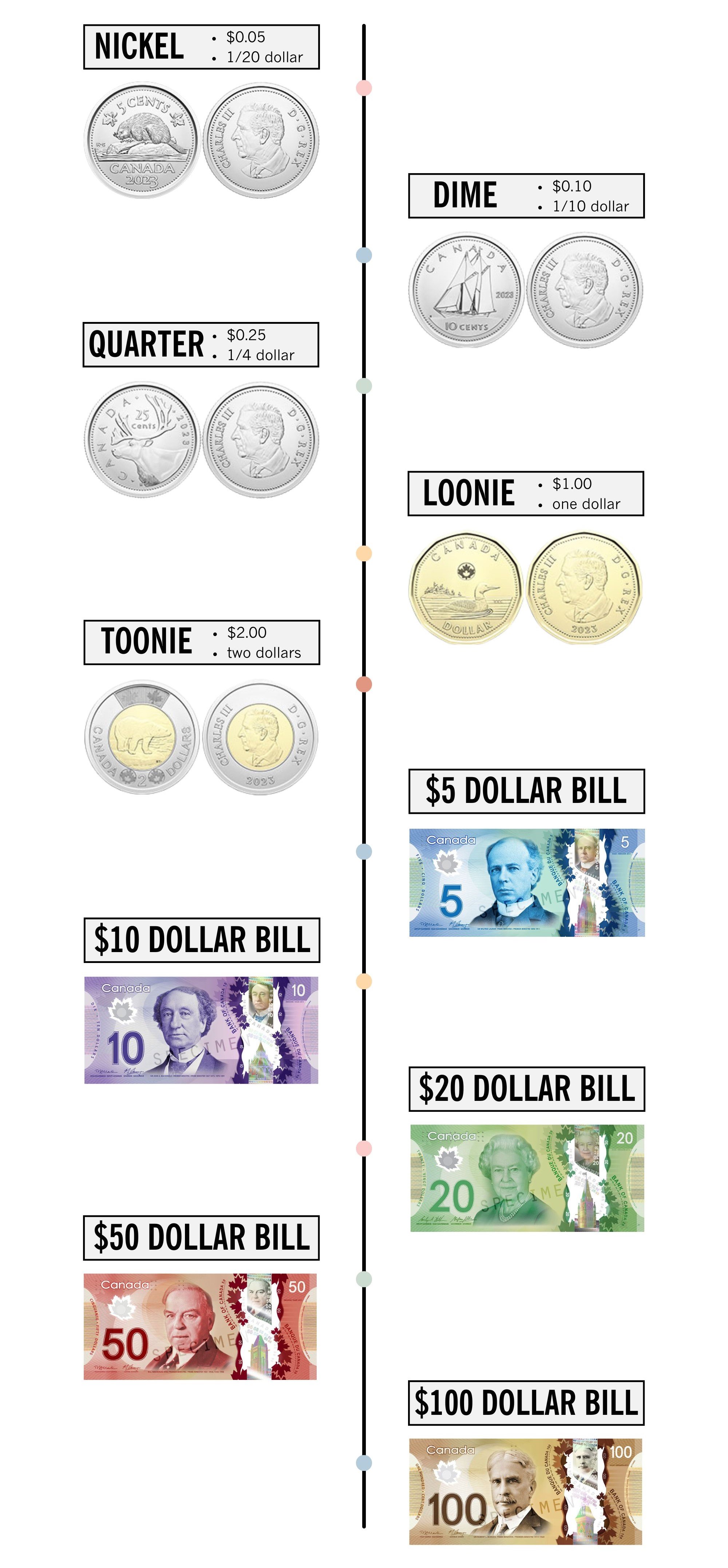

Canada’s official currency is the Canadian dollar ($) and there are 100 cents (¢) in a dollar. Canadian coins have different sizes, shapes and colours, as well as have specific names that are used to identify the amount it is worth.

Paper currency is found in units of $5, $10, $20, $50, and $100, and each of these are clearly marked using numbers and words in both of Canada's official languages (English and French). Each denomination has a distinctive colour to help with identification. Although larger denomination bills are available, keep in mind that not all vendors will accept $50 or $100 bills.

Assess Your Banking Needs

There are several banks in Canada to choose from and it's important to select a bank that suits your needs and lifestyle! Many banks also have student plans that allow for more flexibility, and some even offer newcomer transition services!

Common Banking Institutions:

Bank of Montreal (BMO)

Canadian Imperial Bank of Commerce (CIBC)

Conexus Credit Union

HSBC Bank Canada

National Bank of Canada

Royal Bank of Canada (RBC)

Scotiabank

TD Canada Trust

Taxes in Canada

The Canada Revenue Agency (CRA) administers tax laws for the Government of Canada and for most provinces and territories, in addition to facilitating and overseeing social and economic benefit and incentive programs delivered through the tax system.

International students are permitted and encouraged to file their taxes as they may be eligible for certain benefits or tax credits, such as the GST/HST tax credit or the Canada Child Benefit (CCB).

For students who are working in Canada, it's important to ensure you have a Social Insurance Number (SIN) and file your taxes each year. Important forms you'll need to file your taxes are your T4: Statement of Remuneration Paid slip and T2202: Tuition and Enrolment Certificate form. You will get your T4 from your employer and may receive more than one if you have, or had, more than one job. You can access your T2202 form in UR Self-Service.

Taxes are always filed for the previous year (e.g., taxes filed in 2024 will be based according to any studies or employment in Canada that was done in 2023).

For more information on filing taxes in Canada, please visit the Canada Revenue Agency website.

International Student Services

College West 109

University of Regina

3737 Wascana Parkway

Regina, SK S4S 0A2

Email: International.StudentServices@uregina.ca

Phone: +1(306) 585-5082